Hello Africa,

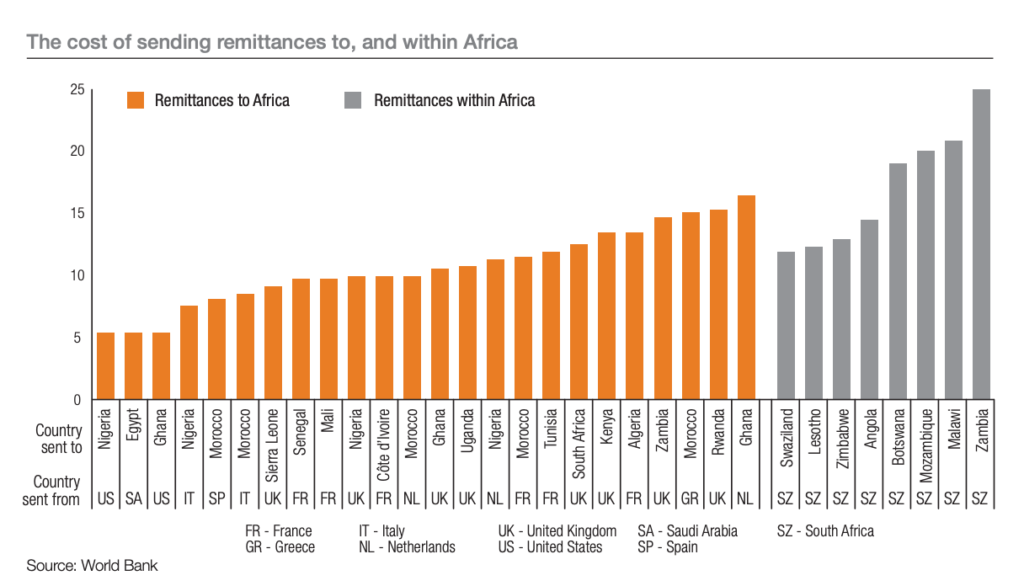

Remittances play a crucial role in the economic landscape of Africa, serving as a significant source of income for many countries on the continent. In 2020 alone, remittances to Africa reached a staggering $55 billion, surpassing all other continents. However, the cost associated with sending remittances to Africa remains high, with an average fee of 7.5% for a $200 transaction, exceeding the global average of 5%.

In the same year, Nigeria alone received $17.2 billion in remittances from abroad. However, according to data from the World Bank, “for every $200 sent in 2020, it cost the sender $17.8 (8.9%).” That translates to about $1.5 billion in missing fees, which is equivalent to Samoa’s GDP.

Nigerians all throughout the country would profit financially if remittance costs were eliminated by utilizing Bitcoin payment rails. Ghana and Kenya both experience comparable circumstances. Fortunately, the Lightning Network, a Layer 2 scaling solution for the Bitcoin blockchain, has emerged as a game-changer in the remittance industry. Let’s delve deep into the role of the Lightning Network in transforming remittances in Africa.

Reduced Costs through the Lightning Network

The Lightning Network offers a significant advantage by reducing the cost of sending remittances. Unlike traditional channels that rely on expensive on-chain transactions, the Lightning Network utilizes payment channels that eliminate the need for blockchain confirmations. This results in significantly lower transaction fees, making remittance services more affordable for Africans.

Additionally, the Lightning Network fosters competition and innovation by enabling the development of various payment channel services. These services can leverage the Lightning Network infrastructure to offer remittance solutions with even lower fees, further reducing costs for

senders and recipients. This increased competition in the remittance market has the potential to drive down fees and provide users with more cost-effective options.

Faster Payments Empowered by the Lightning Network

speed. Traditional remittance methods often involve lengthy processes and waiting periods, which can be burdensome for individuals relying on the funds for their daily needs. However, the Lightning Network enables instant payments between users, bypassing the need for blockchain confirmations. This near-instantaneous nature of transactions has the potential to positively impact the lives of millions of Africans who depend on remittances.

It can swiftly provide funds for urgent needs, such as education expenses for students or essential expenses for families, helping them avoid delays and financial hardships.

Enhanced Convenience in Remittance Transactions

The Lightning Network revolutionizes remittances in Africa by enabling direct peer-to-peer payments, eliminating intermediaries and complex procedures. It is compatible with existing mobile payment infrastructure, providing a convenient and accessible experience. Despite being in its early stages, the Lightning Network has already reduced costs, accelerated transaction speed, and improved the financial well-being of millions in Africa. Financial institutions, service providers, and fintech companies are actively integrating it, leading to a more inclusive

remittance ecosystem. A significant example is the partnership between Strike and Bitnob, leveraging the Lightning Network. This enables instant, low-cost payments to Africa without requiring Bitcoin knowledge. Dollar payments swiftly convert to local currencies, deposited directly into accounts or wallets, free of transaction fees. Available in Nigeria, Ghana, and Kenya, it showcases the Lightning Network’s potential to revolutionize African remittances. Beyond this partnership, the Lightning Network has the potential to revolutionize remittances in Africa in various other ways, demonstrating its transformative capabilities in the region.

Integration with Financial Institutions

The integration of the Lightning Network with traditional financial institutions brings significant changes to the remittance landscape. It enables faster, cheaper, and more secure remittance services, allowing financial institutions to tap into the vast African market and provide enhanced value to their customers

Moreover, the Lightning Network facilitates cross-border transactions between different financial institutions by establishing connections between Lightning Network nodes.

This interconnected infrastructure reduces reliance on correspondent banking relationships with high fees and complex processes. Instead, financial institutions can directly settle cross-border remittances using the Lightning Network, reducing costs and improving efficiency.

Collaboration with Remittance Service Providers

Remittance service providers play a critical role in facilitating the flow of funds across borders. These providers can greatly benefit from adopting the Lightning Network as part of their service offerings. By integrating the Lightning Network into their platforms, remittance service providers can offer their customers faster and more cost-effective remittance options.

Additionally, the Lightning Network enables remittance service providers to expand their reach in Africa.

Through partnerships with local payment processors and mobile money operators, remittance service providers can extend their services to remote areas where access to traditional banking services may be limited. This expansion of coverage ensures that even underserved populations can enjoy the benefits of affordable and convenient remittance solutions.

Conclusion

The Lightning Network has immense potential to transform remittances in Africa. By reducing costs, increasing speed, enhancing convenience, and fostering innovation, it can greatly improve financial well-being. Integration with financial institutions, collaboration with service providers, fintech solutions, and regulatory considerations are crucial for realizing its full potential. Africa can create an inclusive, affordable, and efficient remittance ecosystem by leveraging the Lightning Network’s capabilities for economic growth and empowerment.

SIGN UP FOR OUR WEEKLY NEWSLETTER

"*" indicates required fields

GET UPDATES ON OUR LATEST BLOG POSTS

Subscribe with your favorite RSS reader (eg, feedly) to get updates on our latest blog posts. Simply click the ‘RSS‘ button above and paste the url link in the reader to subscribe.